State general revenue in January dipped by $22.5 million from the same month last year to $560.5 million, falling $3.8 million, or 0.7 percent, short of the state’s forecast.

The state’s chief fiscal officer, Richard Weiss, said the year-to-year decline in state tax collections was expected and largely resulted from lower individual income-tax collections.

Income-tax revenue spiked in January 2013 with taxpayers paying earlier than usual to avoid an increase in federal taxes, he said.

January’s sales- and use tax collections inched up by $0.3 million compared with a year ago, the state Department of Finance and Administration said Tuesday in its monthly revenue report. Last month’s sales- and use-tax collections by the state largely resulted from sales made by businesses in December.

Gov. Mike Beebe said last month’s sales-tax collections were “a little weak” and could stem from bouts of bad weather dampening retail sales.

Richard Wilson, assistant director of research for the Bureau of Legislative Re-search, said Christmas season retail sales started out strong but closed weakly.

Individual income taxes and sales and use taxes are the two largest sources of state general revenue.

The $583 million collected in the f irst month of 2013 was the most ever raised in January, said George Foy, a tax analyst for the finance department.

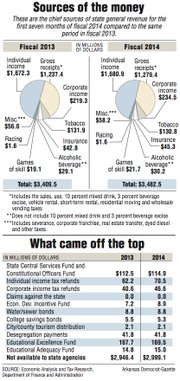

During the first seven months of fiscal 2014, the state’s general revenue has increased by $73 million (2.1 percent) over the same period in fiscal 2013 to $3.48 billion. That’s $23.1 million (0.7 percent) above the state’s forecast.

Tax refunds and some specific government expenditures, such as court-mandated desegregation expenses, come off the top of gross general revenue, leaving a net amount that agencies are allowed to spend.

During the first seven months of fiscal 2014, the net has increased by $52.7 million (1.8 percent) over the same period in fiscal 2013 to $2.99 billion. That’s $39.6 million (1.3 percent) above the state’s forecast.

The January revenue report comes with the Legislature set to start its fiscal session Monday to consider Beebe’s proposed $5 billion general revenue budget for fiscal 2105; a $105.8 million increase in state spending over fiscal 2014.

Beebe’s proposed budget factors in an $85.2 million reduction in general-revenue collections stemming from tax cuts enacted by the Legislature in 2013 and up to $89.2 million in projected savings resulting from federal Patient Protection and Affordable Care Act funding and the state’s use of federal aid to purchase private health insurance for poor Arkansans, according to state officials.

Weiss said he doesn’t have any concerns about the state’s current general revenue forecast, which he described as “very, very conservative.”

In January, according to the department:

Individual income-tax collections declined by $21.4 million (6.3 percent) over a year ago to $320 million. That’s $6.3 million (2 percent) above the state’s forecast.

The decline in individual income-tax collections reflected “the offset of early payments last year from taxpayers avoiding higher federal rates,” the department said.

But “better than expected payroll withholding also aided the [2014] results,” with individual withholdings increasing 2 percent last month compared with a year ago, the department said. The state’s unemployment rate dipped from 7.5 percent in November to 7.4 percent in December, the U.S. Bureau of Labor Statistics reported last month.

Wilson said the finance department “did a good job of anticipating the size of the negative effect “from the “income shifting” because of the higher federal tax rates.

“We will see more negative effect show up in the April report,” he said.

Sales and use taxes increased by $0.3 million (0.2 percent) from a year ago to $178.6 million. That’s $7.4 million (4 percent) below the state’s forecast. Weaker-than-expected retail sales accounted for lagging sales tax collections, according to the department.

Weiss said retail sales were sluggish during the Christmas season across the nation. The slow growth in sales is across the board and doesn’t reflect a downturn in any particular sector, said Tim Leathers, the finance department’s deputy director.

Corporate income-tax collections increased by $3 million (10.9 percent) over a year ago to $30.9 million. That’s $3.1 million (11.2 percent) above the state’s forecast.

Corporate income taxes are a volatile source of tax collections and often reflect corporations’ federal income-tax strategies, according to state officials.

Front Section, Pages 1 on 02/05/2014