A proposed hotel on the University of Arkansas' Fayetteville campus may hinge on allocations from the federal New Markets Tax Credits Program, with announcements from the program not expected until May or June.

"Our intention remains to avoid putting new public funds into the project," Laura Jacobs, a university spokesman, wrote in an email.

Despite the university having in June selected developer Acquest Realty Advisors Inc. and operator FLIK International Corp. for negotiations on the project, Chancellor G. David Gearhart in September publicly signaled that the hotel was in wait-and-see mode.

"A lot of it's going to be depending on tax credits," Gearhart said while giving an overview of campus construction projects at a meeting of UA's faculty senate.

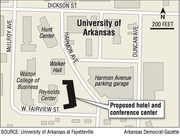

The proposed hotel and conference center would be constructed near buildings that are a part of the Sam M. Walton College of Business. Gearhart said such a hotel would provide a place for events like alumni banquets, which frequently take place off campus because of a lack of suitable space.

But several uncertainties surround projects tied to unallocated tax credits. The New Markets program exists to spur development within low-income communities by offering incentives for investors.

Community eligibility is determined at the census tract level, said Sam Walls, chief operating officer and president of Arkansas Capital Corporation. Such tracts are small, geographic units utilized by the U.S. Census Bureau. The site of the proposed hotel is within an eligible tract for the New Markets program, Walls said.

Specialized financial organizations known as Community Development Entities apply for tax credit allocations. Walls said the Arkansas Capital Corporation has been allocated about $200 million in New Markets tax credits since the federal program began in 2000. The credits have been used, for example, to help finance construction of Fayetteville's Chancellor Hotel, Walls said.

In general, developers or businesses work with a Community Development Entity or several entities to move forward with a project in a low-income community. The tax credit allocations allow a Community Development Entity to attract investors, who receive tax credits for their own use after providing capital for such projects.

Walls said the Arkansas Capital Corporation has spoken with UA about the hotel project. But the allocation process is "a hugely competitive program," Walls said. For every dollar allocated by the government, "they tend to have $10 to $12 in requests," Walls said.

For a large project like UA's proposed hotel -- which originally had cost estimates of $32 million to $35 million -- Walls said it would take the involvement of several Community Development Entities. However, putting together such partnerships can sometimes be difficult, he noted, with some entities having a narrow focus either geographically or on certain types of construction.

UA will "have to find CDEs who like the deal, who can do the deal," Walls said.

Metro on 12/26/2014