Caterpillar Inc., already battered by a slump in demand for its mining machinery, faces slowing sales of compressors, pumps and gas turbines as oil companies reduce spending.

The impact will be felt by Caterpillar in early 2015 as drillers cut back and exploration declines, Chairman and Chief Executive Officer Doug Oberhelman said during a Bloomberg Television interview Tuesday.

While Caterpillar forecast in October that sales will be flat to slightly up in 2015, that view might now be optimistic given the decline in crude prices in the past two months, Sameer Rathod, an analyst at Macquarie Group Ltd., said in a Dec. 16 report.

"The bottom line is, it's a new risk for Caterpillar's earnings outlook for 2015," said Matt Arnold, a St. Louis-based analyst for Edward Jones & Co.

Caterpillar's energy and transportation segment had been a bright spot amid the gloom in the construction and mining markets. The company has seen revenue fall by about $10 billion since 2012 as lower metals and coal prices meant miners bought fewer shovels and trucks. Construction-equipment sales have been slow to recover since the recession.

While the Peoria, Ill.-based company's signature yellow diggers and trucks are still a core business, it has expanded in the energy market with the acquisition of German engine maker MWM Holding GmbH in 2011. Caterpillar may look at more oil and gas deals, Oberhelman said.

Caterpillar's turbines are found on offshore oil rigs while its engines and compressors are used to move oil from wells to pipelines and rail cars. The oil and gas industry accounts for $6 billion to $7 billion of sales.

A Caterpillar spokesman declined to comment on the effect of oil prices beyond what was said by Oberhelman in his interview and by another senior company executive at a Dec. 2 investor conference. Turbines used on large production platforms and engines used to move oil and gas from wellheads to pipelines are affected less by short- or medium-term fluctuations in oil prices than engines used for drilling and well-servicing, Mike DeWalt, a Caterpillar vice president, said at the conference.

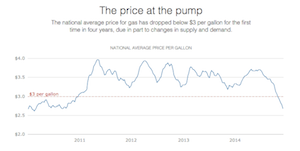

With oil heading for its biggest annual slump since 2008, energy companies are scrambling to adjust their costs. Continental Resources Inc., a U.S. producer of oil from shale-rock formations, said this month that it plans to lower spending by 41 percent. Wider high-yield credit spreads on energy companies are a negative for those looking to finance new oil and gas infrastructure, Rathod said.

Oil and gas "has likely entered a prolonged period of volatility at best and/or a long down cycle," said Ann Duignan, a New York-based analyst for JPMorgan Chase & Co. who covers Caterpillar and recommends holding the stock.

Caterpillar is likely to give its initial 2015 profit forecast Jan. 27 when it reports fourth-quarter earnings. That guidance may disappoint, said Macquarie's Rathod, who has a sell rating on the shares. An estimated 15 percent of Caterpillar's machinery revenue and as much as 20 percent of operating profit may be at risk because of the energy-industry slowdown, he said.

Caterpillar shares rose 22 cents to close Wednesday at $93.72 in New York. They've gained 3 percent this year.

The full impact of lower crude prices on Caterpillar depends on how low they go and how long they stay there, Edward Jones' Arnold said.

With its sensitivity to the pace of construction and commodities demand, Caterpillar is often seen as an economic bellwether. But while lower oil prices may hurt one segment of the company, they may end up helping the wider economy and thus become a positive for Caterpillar, said Lawrence De Maria, an analyst for William Blair & Co. in New York who has a buy rating on the shares. Caterpillar's CEO made the same observation.

"It should be positive on out into the future as the world gets this huge stimulus package of lower energy and works that through its system," Oberhelman said.

In the shorter term, Caterpillar's customers are going to feel the effects of current oil prices, after years at levels of $100 or more, he said. "There is no question about it."

Business on 12/25/2014