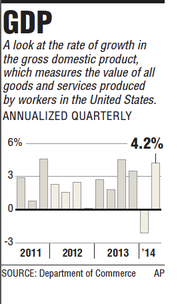

Updating lifts GDP's rise to 4.2%

In this Aug. 7, 2014 photo a worker assembles construction supplies at Northeast Building Products in Philadelphia. The Commerce Department issues its second estimate of how fast the U.S. economy grew in the April-June quarter on Thursday, Aug. 28, 2014.

Friday, August 29, 2014

WASHINGTON -- The economy in the U.S. expanded more than previously forecast in the second quarter, propelled by the biggest gain in business investment in more than two years.

Gross domestic product, the value of all goods and services produced, rose at a 4.2 percent annualized rate, up from an initial estimate of 4 percent and after a first-quarter contraction, the Commerce Department reported Thursday.

During a White House news conference Thursday, President Barack Obama took note of the upward revision to growth.

"There are reasons to feel good about the direction we are headed," Obama said.

"Companies are investing; consumers are spending," he said.

Still, he acknowledged that "there is a lot more that we should be doing to make sure that all Americans benefit from the progress that we have made."

The upward revision supported expectations that the economy in the second half of 2014 will prove far stronger than the first half.

"The recovery is becoming more well-entrenched," said Scott Brown, chief economist at Raymond James & Associates Inc. in St. Petersburg, Fla. "There is more optimism among businesses about increased demand."

The economy shrank at a 2.1 percent annual rate in the January-March quarter. That was the economy's biggest drop since the depths of the recession, and it reflected mainly the effects of a harsh winter that kept consumers away from shopping malls and disrupted factory production.

Many economists say they expect growth of about 3 percent in the current July-September quarter and for the rest of the year. The Commerce Department's upwardly revised estimate of business investment last quarter showed capital spending growing at an annual rate of 8.4 percent last quarter. That was sharply higher than the government's initial 5.5 percent estimate.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said the strength in business investment has likely extended into the current quarter, lending support to the economy.

With the wild swing between the first quarter's sharp slump and the vigorous rebound last quarter, annual economic growth has averaged a meager 1.1 percent for the first six months of this year.

Because of the rocky start, some economists think growth for all of 2014 will average just 2.1 percent, little changed from last year's 2.2 percent increase. The Congressional Budget Office on Wednesday offered a more conservative estimate for the economy, saying it will grow 1.5 percent this year, dragged lower by the poor performance in the first three months of the year.

They're more optimistic about 2015. Many expect growth to accelerate to 3 percent, an indication that the economy is finally gaining cruising speed after the deep 2007-2009 recession, the worst since the 1930s. The recession officially ended in June 2009 and over the past five years, the economy has turned in subpar growth rates averaging about 2 percent a year.

"I am looking for 2015 to be a better year, assuming geopolitics don't get in the way," said Sung Won Sohn, an economics professor at California State University, Channel Islands. Economists worry that any of several political hot spots, from Ukraine to Israel to Iraq, could erupt in a way that would destabilize U.S. and global growth.

But Sohn said numerous factors should support growth in the second half of this year and in 2015. The principal strength is expected to come from further improvement in the job market.

In July, employers added 209,000 jobs, the sixth-straight month of solid 200,000-plus job growth. Those gains have averaged 244,000 a month since February, the best six-month string in eight years.

Economists also foresee the unemployment rate, now a nearly normal 6.2 percent, going even lower. The July unemployment rate in Arkansas was 6.2 percent, down from 7.3 in July 2013.

An improving job market means rising household incomes, higher consumer confidence and more consumer spending. That is critical to growth because consumer spending accounts for more than two-thirds of economic growth.

Besides more jobs translating into more spending power, economists think other forces, such as business investment, stronger state and local finances, and rising exports, will also support growth in coming months.

More hiring and stock-market gains that are increasing confidence also are healing household finances, which will help consumer spending. Payrolls in July marked the sixth month of gains exceeding 200,000, the longest such stretch since 1997, according to the Labor Department.

Gap Inc., the owner of chains including its namesake, Banana Republic and Old Navy, is among companies hoping to benefit from an improving environment for shoppers. The San Francisco-based retailer posted second-quarter profit that topped analysts' estimates.

"The consumer is feeling slightly better, which we think is good for the overall industry," Chief Executive Officer Glenn Murphy said on an Aug. 21 conference call with investors.

Stripping out inventories and trade, the two most volatile components of GDP, so-called final sales to domestic purchasers increased 3.1 percent, up from a previously reported 2.8 percent gain and the biggest advance in four years.

The GDP estimate is the second of three for the quarter, with the third release scheduled for late September when more information becomes available.

Information for this article was contributed by Martin Crutsinger of The Associated Press and by Shobhana Chandra and Alex Tanzi of Bloomberg News.

A section on 08/29/2014