Wal-Mart Stores Inc. reported second-quarter earnings Thursday that met analysts' estimates as well as its own; however, the company scaled back its earnings predictions for the rest of the year, citing higher health care costs, a larger investment in e-commerce and an elevated tax rate.

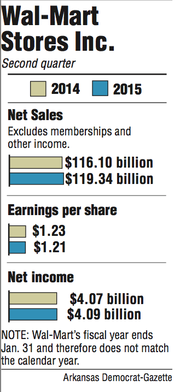

For the three months ended July 31, the world's largest retailer reported earnings per share of $1.21, compared with $1.23 in the second quarter of fiscal 2014 -- a 1.6 percent slide. Net income rose slightly, 0.6 percent, to $4.09 billion. Companywide, net sales showed slight gains for the sixth consecutive quarter, up 2.8 percent to $119.34 billion from $116.10 billion last year. Wal-Mart's fiscal year ends Jan. 31.

Wal-Mart's international segment performed well, growing faster than the market in every country it's in except China. Net sales for international were up 3.1 percent to $33.9 billion. The company's smaller-format U.S. grocery stores, Neighborhood Markets, posted same-store comparable sales growth, often called "comps," between 5 percent and 6 percent, and e-commerce continues to blossom with more acquisitions and the recent unveiling of a streamlined walmart.com.

The company lowered its full-year earnings per share guidance to a range of $4.90-$5.15 from $5.10-$5.45. Predictions take into account a swell in health care costs to $500 million from about $330 million and a 5-cent to 7-cent per-share stake in e-commerce, up from previous estimates of 2 cents to 4 cents. Sales from e-commerce grew about 24 percent in the quarter with double-digit growth in Wal-Mart's four most important markets: United States, United Kingdom, China and Brazil.

Brian Yarbrough, senior analyst for Edward Jones in St. Louis, said shareholders are likely to be disappointed by Thursday's results.

"They're wanting to see growth, and they're wanting to see improvement in the U.S., and that continues to elude the company," Yarbrough said.

Wal-Mart Stores Inc. President and CEO Doug McMillon said stronger sales in U.S. businesses would've helped raise profits. Net sales for Wal-Mart U.S. rose $1.9 billion, or 2.7 percent, to more than $70 billion.

"I'm encouraged that we're gaining traction on our goal to have a positive comp by year end, but I'm not satisfied," McMillon said.

A note from a team of research analysts at Credit Suisse said Wal-Mart's second-quarter results "clearly signaled the beginning of the transition in strategy, as the company heightened its focus on the domestic business and e-commerce."

McMillion's declaration places increased pressure on Greg Foran, Wal-Mart U.S.'s new president and CEO, who's only five days into the job. He replaces Bill Simon, who is leaving the company at the end of January.

Foran on Thursday vowed to improve customer service as a means of improving traffic. "Being in stock, clean stores, the right price, the right items, improved service and better productivity" are key to drawing customers, he said. During the quarter, Wal-Mart U.S. gave employees more work hours in specific areas such as the deli, bakery and overnight stocking at a cost of about $200 million.

"It's no surprise that they're willing to or want to spend a little bit more money in the store, basically admitting they'd gone a little bit too far in cost savings," said John R. Lawrence, managing director of equity research at Stephens Inc. in Memphis.

Lawrence predicted even more sales growth from Wal-Mart's smaller-format stores. The company is building 200 Neighborhood Markets and 100 Express stores in fiscal 2015. The Express stores, which have as many items as a dollar-type store or large convenience store, are still in the pilot phase and are rolling out slowly. During the second quarter, Wal-Mart opened or reopened 35 Supercenters, though same-store sales declined.

There was much rhetoric Thursday about the future of the Supercenter. Management declared them valuable; some analysts deemed them outdated and a waste of capital.

"Expect changes in the capital allocation of new builds by the time we get to October," Lawrence said, referring to the date of third-quarter earnings release.

Randy Koontz, first vice president of investments for Pinnacle Wealth Management of Raymond James & Associates Inc. in Rogers, said tax rates and health care costs are "just a cost of doing business."

"If they're higher, that's going to get passed along to the consumer," Koontz said. "It's a business expense. They may not call it that, but that is what it is."

In the last two weeks, Jefferies Group scaled back its target price on Wal-Mart from $89 to $76, though it maintained its "hold" rating on the stock. Also, investment bank Goldman Sachs downgraded Wal-Mart's stock to "neutral" from "buy," declaring that big-box stores are losing customers to online retailers and stores with more focused inventories.

Wal-Mart stock closed Thursday at $74.39 per share, up 36 cents from the previous day's close.

Business on 08/15/2014