Correction: In its application to the U.S. Department of Health and Human Services for approval of expanding Medicaid through private insurance plans, the Arkansas Department of Human Services listed $118 million as the estimated monthly cost of providing coverage to about 250,000 adults with incomes of up to 138 percent of the federal poverty level in 2014. This article incorrectly described the cost estimate.

The premiums for insurance plans sold on Arkansas’ exchange will be about 25 percent less than what the companies had originally proposed and below what independent forecasters predicted, the Arkansas Insurance Department announced Monday.

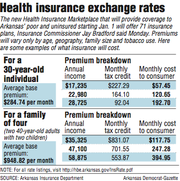

For a 30-year-old nonsmoker, the average monthly premium of the plans sold on the exchange will be $284.74, but federal tax credit subsidies will reduce the premium for those with incomes of upto 400 percent of the federal poverty level.

For instance, for someone with an income of $17,235, or 150 percent of the poverty level, the tax credit would pay $227.29 of the premium, with the consumer paying $57.45.

For plans covering two 40-year-olds with two children, the average premium would total $948.82. For a family with a household income of $35,325, also 150 percent of the poverty level for that household size, the credit would reduce the premium to $117.75.

Adults with incomes below 138 percent of the poverty level - $15,860 for an individual or $32,500 for a family of four - will be able to sign up for a private plan on the exchange and have their premiums paid by Medicaid.

Amy Webb, a spokesman for the state Department of Human Services, said the premiums are in line with what the department used in estimating the cost of expanding the state’s Medicaid program through the private insurance plans. About 250,000 people are expected to be eligible for the Medicaid-funded coverage.

Gov. Mike Beebe said the rates were about 10 percent less than state officials expected.

“It is a better deal for taxpayers and everybody,” Beebe said. “It may not be a better deal for insurance companies.”

In all, about 500,000 Arkansans are expected to be eligible for subsidized coverage through the exchange, which is being set up by the U.S. Department of Health and Human Services in a partnership with the state.

The income threshold for the tax credit subsidies is $45,960 for an individual or $94,200 for a family of four.

Enrollment in the exchange will begin Oct. 1 for coverage that will start in January.

On Friday, the Legislative Council declined to review a $4.5 million Insurance Department contract extension for a campaign aimed at encouraging people to obtain coverage through the exchange, with some legislators saying they wanted to see the rates first.

Rep. Douglas House, R-North Little Rock, who made the motion for the delay, said the rates appeared to be “encouraging,” but he didn’t know whether he would support the contract.The state could communicate in other ways, such as by sending notes home with children from school, he said.

“It’s just a lot of money we’re spending,” House said.

Insurance companies submitted their plans to the Insurance Department in June, and the department recommended the plans for approval to the federal Centers for Medicare and Medicaid Services on July 31.

Insurance Department spokesman Heather Haywood said the initial rates proposed by the companies were reduced by about 25 percent during the review.

Sen. Jonathan Dismang, R-Searcy, a sponsor of the legislation authorizing the expansion of the state’s Medicaid program through plans offered on the exchange, said the rates seemed to be “positive” but that it would take more analysis to know the effect on the cost of the Medicaid expansion.

In its application to the federal Health and Human Services Department’s Centers for Medicare and Medicaid Services for approval of Arkansas’ method of expanding the program, the state estimated the cost at $118 million in 2014.

The federal government will pay the full cost of the expansion until 2017, when the state will begin paying 5 percent of the cost for the newer recipients. The state’s share will then rise every year until it reaches 10 percent in2020.

Health-insurance exchanges are being set up in every other state under the 2010 federal health care overhaul law.

Arkansas Blue Cross and Blue Shield, the national Blue Cross and Blue Shield Association, QualChoice Health Insurance, and Centene Insurance Co.’s Arkansas Health and Wellness Solutions, formerly known as Celtic Insurance Co., have applied to offer plans on Arkansas’ exchange.

Arkansas Blue Cross and the national Blue Cross association will offer plans in every county. Qualchoice will offer plans in 51 counties - all of those except the ones in the southeast and southwest coverage regions delineated by the state Insurance Department.

According to information released by the Insurance Department on Monday, Arkansas Health and Wellness Solutions will offer plans in the central, northwest and west-central regions designated by the department.

That will leave the southeast and southwest regions, covering 24 counties, with plans only offered by two companies - Arkansas Blue Cross and the national Blue Cross association. The northeast and south-central regions will have plans offered by three companies, and the central, northwest and west central regions will have plans offered by all four companies.

The plans will be labeled according to the amount of medical expenses they are designed to cover for the typical patient. Bronze plans must be designed to cover 60 percent of a patient’s expenses. Silver plans must cover 70 percent of expenses, and gold plans must cover 80 percent of expenses. Companies can also offer platinum plans, designed to cover 90 percent of expenses, but no companiesare offering such plans in Arkansas.

Those who apply for Medicaid coverage will enroll in silver plans, but the Medicaid program will reduce any outof-pocket cost to the recipient through copayments. For 2014, recipients will have to pay no more than $604.

Arkansas Blue Cross and QualChoice are also offering catastrophic plans, available to those who are age 30 or younger or who would otherwise have to pay more than 8 percent of their incomes to buy insurance. The tax credit subsidies cannot be used for the catastrophic plans, however.

Max Greenwood, a spokesman for Arkansas Blue Cross and Blue Shield, said the premiums for plans offered in the exchange are higher than those for plans available in the individual market now because of the requirements of the federal health-care law.

For coverage that begins in January or later, companies will not be able to turn down people who have costly medical conditions or charge them more.

Companies also cannot charge women higher premiums than men and are limited in how much more they can charge older people than younger people. The plans are also required to cover some services, such as therapy for the developmentally disabled, that most insurance policies don’t cover now.

Rep. David Meeks, R-Conway, said he hadn’t studied the rates Monday but remains opposed to the expansion of the state’s Medicaid program, which he said will be too costly.

He said he will oppose the extension of the contract to promote the exchange.

Noting that U.S. Sen. Max Baucus, D-Mont., predicted in April that the law’s implementation will be a “train wreck,” Meeks said, “I definitely don’t want to spend more money to try to get people to board this train.” Information for this story was contributed by Michael R. Wickline of the Arkansas Democrat-Gazette.

Front Section, Pages 1 on 09/24/2013