Murphy Oil’s quarterly profit jumps 26%

Thursday, October 31, 2013

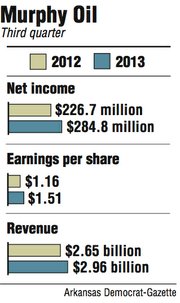

Murphy Oil Corp. turned a profit of $284.8 million in the third quarter, up 26 percent from the same period a year ago, the El Dorado company said Wednesday.

Murphy Oil’s earnings were helped by an increase in income from discontinued operations that came mainly from the company’s retail business, which the company recently separated from its production and exploration business, creating a new publicly owned company.

As a result of the spinoff, the new company, Murphy USA Oil Corp., paid Murphy Oil a $650 million cash dividend that was mainly used to repay a portion of its long term debt.

Excluding discontinued operations, Murphy Oil saw a profit of $252.1 million, compared to $211.7 million the year before, missing analysts estimates of an adjusted net income of $277.7 million.

Murphy Oil said income from continuing operations increased during the quarter because of higher crude oil production levels.

Pavel Molchanov, an analyst with Raymond James and Associates, said he expected earnings per share of $1.69, which was down slightly from the company’s second quarter this year because Murphy expected lower production during the third quarter.

“On the flip side, oil prices are higher, so it may be close to a wash,” Molchanov said in an email.

Earnings per share for the quarter were $1.51, up from $1.16 in the same period last year. The company’s quarterly revenue came in just below $3 billion, an increase from the previous year’s $2.65 billion.

Murphy Oil said it brought in $264.2 million during the quarter from its exploration and production business, compared to $221.1 million in the same period last year.

The increase was attributed to higher crude volumes from the Eagle Ford Shale in Texas. The company said an increase in revenue from the higher oil volumes was partially offset by more expenses in its exploration program.

“We have been pleased with production levels that have exceeded our targets, with Eagle Ford Shale oil volumes leading the way,” Roger Jenkins, president and chief executive officer of the company said in a statement.

He said the completion of the company’s spinoff of its retail unit was an important step into transforming Murphy into a solely exploration and production organization.

Murphy Oil’s refining and marketing operations in the United Kingdom reported a loss of $12.9 million during the quarter. The decline is attributed to weaker refining margins at its refinery in Milford Haven, Wales.

Murphy Oil has unsuccessfully been trying to sell its U.K. refining and marketing business.

Shares of Murphy Oil fell 81 cents, or 1.3 percent, Wednesday on the New York Stock Exchange to close at $62.02. The company’s earnings report was released after markets closed.

Murphy Oil will hold a conference call to discuss its quarterly results today at 12 p.m. The call can be accessed by going to the company’s website at http://ir.murphyoilcorp.com.

Business, Pages 25 on 10/31/2013