2 state banks said primed for expansion

Home BancShares, Ozarks can leverage value of stock

Sunday, October 27, 2013

The next 12 to 24 months will “represent a golden age of bank mergers and acquisitions for a select few” banks, says an investment banking analyst in Little Rock.

And at least two Arkansas banks are primed to take advantage of the opportunity, said Matt Olney, who covers publicly traded banks at Little Rock-based Stephens Inc.

Olney lists only five banks of about 25 mid-size regional banks he covers as being best situated for acquisitions. Those five are Bank of the Ozarks in Little Rock; Home BancShares of Conway; First Financial Bankshares of Abilene, Texas; Renasant Corp. of Tupelo, Miss.; and Hilltop Holdings of Dallas.

“This is a unique period in bank history,” Olney said.

Olney expects the overall number of acquisitions nationally to remain sluggish compared with historical levels, he said in a recent research report.

There were 54 acquisitions by banks in the country in the three-month period that ended Sept. 30, but the price paid for the banks was at the highest level since early 2010, Olney said.

“We believe the higher priced [acquisition] deals will result in less competition for the acquirers that have strong currencies,” Olney said, speaking of the banks’ stock values.

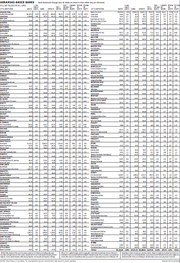

Only 40 banks - or 7 percent of publicly traded banks in the country - are trading at more than two times tangible book value - a way to value a company on a per share basis by measuring its equity after removing intangible assets.

Bank of the Ozarks and Home BancShares are in an even more elite category, each trading at more than three times the tangible book value. Only 2 percent of banks in the country are at that level, Olney said.

Nearly half of the publicly traded banks in the country trade at less than their tangible book value.

A lot of banks wanting to sell would prefer to be paid in stock, he said.

Home BancShares and Bank of the Ozarks have a major advantage in the value of their stock, said Olney, who doesn’t own stock in either of the banks.

“Longer term, they’re still going to be at a premium valuation versus their peers, but it won’t get more dramatic than this,” Olney said. “I think the overall valuation of the industry will improve over time. As rates rise and the economy improves, there will be a leveling of the playing field over the next several years.”

Bank of the Ozarks has accumulated a “sizable war chest of capital” in recent years, George Gleason, chairman and chief executive officer of the bank, said in a recent conference call.

“We continue to be active in identifying and analyzing [acquisition] opportunities and we expect this will be an important part of our business [in the future],” Gleason said.

Bank of the Ozarks started a mergers-and acquisition-division last year and has been getting many calls from banks that would like to sell, Olney said.

Bank of the Ozarks bought First National Bank of Shelby, N.C., in January for $64 million.

“So I would expect the number of deals they do to really ramp up in the next year or two,” Olney said.

Several potential target banks have approached Bank of the Ozarks and said they would like to be acquired by the Little Rock bank, Gleason said.

The banks have said they believe they would be a good acquisition and that they would benefit from owning Bank of the Ozarks stock instead of their private stock, Gleason said.

“So, yes, I think we are a preferred acquirer,” Gleason said. “We’re seeing more opportunities than we have time to look at.”

Both Home BancShares and Bank of the Ozarks have had significant increases in their stock price after recent acquisitions, Olney said.

Four weeks after Home BancShares announced on June 25 that it would pay $280 million to buy Liberty Bancshares of Jonesboro, its stock increased 29 percent. HomeBancShares’ stock has traded between $15.38 and $33.34 in the past 52 weeks.

Four weeks after Bank of the Ozarks bought First National Bank on Jan. 24,its stock price rose 8 percent. Its stock has ranged between $30.76 and $49.35 over the past 12 months.

Nationally, banks that have made acquisitions this year have had an average 6 percent increase in their stock price weeks after the announcement, compared with little change in the acquirer’s stock price after purchases from 2000 to 2012, Olney said.

“We’ve been in an environment over the last several quarters where any deal that got announced seemed to have a favorable response for the acquirer’s stock,” Gleason said.

Olney expects Bank of the Ozarks and Home BancShares each to buy about $1 billion in assets in the next 12 months.

Home BancShares doesn’t plan on making more acquisitions until it gets its purchase of Liberty “under our belt,” possibly next year, said John Allison, Home BancShares’ chairman. The Liberty purchase closed last week, and Home BancShares expects the conversion of Liberty to the same operating systems to be completed in December.

The potential for more acquisitions is still out there.

“I’ve been looking for other opportunities,” Allison said earlier this month.

He talked with one Florida bank that could be a possible acquisition a few weeks after buying Liberty, Allison said.

“If these deals are still around [next year], I’m going to continue to work them,” Allison said.

Even with the uncertainity of new federal regulations for banks, Allison said he anticipates that Home BancShares will exceed $10 billion in assets at some point.

“There are too many opportunities,” Allison said. “I think we’d be negligent with as many deals as there are out there if we don’t take advantage” of the bank’s stock.

Other banks in Arkansas are also seeking acquisitions.

“For the next foreseeable future, I believe you’ll continue to see consolidation in Arkansas banks,” said Garland Binns, a Little Rock banking attorney. “For instance, the cost of operations for a $100 million bank is the same as for a $400 million bank in Arkansas.”

So for those smaller banks to meet the increasing cost to do business because of additional regulatory requirements, they will have to grow or sell, Binns said.

In recent months, privately owned Arvest Bank of Fayetteville has announced the purchase of North Little Rock based National Bank of Arkansas and dozens of branches of Bank of America.

Simmons First National Bank of Pine Bluff recently won a bankruptcy auction by bidding $53.6 million to buy Rogers Bancshares, parent company of Metropolitan National Bank.

Weeks before publicly traded Simmons won the bid, George Makris Jr., Simmons’ chief executive officer-elect, said the bank was in discussions with six banks about possible purchases.

“Many of those banks are local community banks who still have founders involved,” Makris said. “And the hardest thing for us to overcome is the education part of those owners with regard to the value of their company. I will have to tell you that the sellers’ expectations are still a little higher than the market will bear right now.”

Business, Pages 68 on 10/27/2013