WASHINGTON - Purchases of previously owned homes in the U.S. fell in September for the first time in three months, retreating from an almost four-year high as rising prices and mortgage rates discouraged would-be buyers.

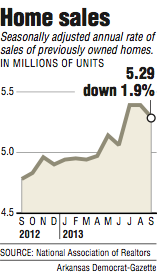

On Monday, the National Association of Realtors said that sales of resold homes fell 1.9 percent last month to a seasonally adjusted annual rate of 5.29 million. That’s down from a pace of 5.39 million in August, which was revised lower.

“We see a little bit of a bumpy ride,” said Kevin Cummins, an economist at UBS Securities LLC in Stamford, Conn., who correctly projected the drop in sales. “The jury is still out on home sales and how much of a pullback we might see due to higher mortgage rates.”

Mortgage rates rose sharply during the summer from their historic lows, threatening to slow a housing recovery that began last year and has helped drive modest economic growth.

Many economists expect home sales will remain healthy, especially now that rates have stabilized and remain near historically low levels. Final sales in September reflected contracts signed in July and August, when rates were about a percentage point higher than in May.

The average rate on a 30-year fixed mortgage was 4.28 percent last week, down from a two-year high of 4.58 percent in August. That’s also far below the 30-year average of 7 percent, according to Bankrate.com.

Sales of existing homes have risen at a healthy 10.7 percent in the past 12 months. Still, that’s the slowest year-over-year increase in five months. The sales pace in August matched July’s pace - making both the highest in four years and consistent with a healthy market.

And the median home price has risen 11.7 percent in the past year, the Realtor association said. That’s also the slowest annual gain in the past five months.

The median price of an existing home increased to $199,200 from $178,300 in September 2012, Monday’s report showed. Purchases increased 15.1 percent in September from the same month last year before adjusting for seasonal variations.

Purchases of single-family homes decreased 1.5 percent to an annual rate of 4.68 million. The sales pace of multifamily properties, including condominiums, declined 4.7 percent to a 610,000 pace.

Purchases declined in three of four regions, led by a 5.3 percent drop in the Midwest. Demand increased 1.6 percent in the West.

Existing-home sales, which are tabulated when a purchase contract closes, are recovering from a 13-year low of 4.11 million in 2008. Annual purchases reached a record 7.08 million in 2005.

Price increases may be slowing because more homes are finally coming on the market. The supply of available homes rose 1.8 percent from a year ago to 2.21 million, the first year-overyear increase in 2 ½ years.

The number of houses on the market still needs to rise by 30 percent to 40 percent to stabilize conditions, said Lawrence Yun, the Realtor association’s chief economist.

The limited number of homes for sale is a key reason prices have risen so fast in the past year.

Affordability and population growth will continue to fuel demand and push up home prices, said Steve Schwarzman, chairman and chief executive officer of Blackstone Group LP, which bought about 40,000 single family homes after real-estate prices slumped in 2007 and 2008. Those properties, which the New York-based investment group rents out, continue to gain value, he said.

“We wanted to take advantage of the fact that, for a five-year period, the number of houses that was built was like half of what was needed,” Schwarzman said on a Thursday earnings call.

The economy is growing modestly and employers are adding jobs at a slow but steady pace. That’s helped a growing number of Americans buy homes.

Still, many first-time buyers have been unable to enter the market. They made up just 28 percent of purchases in September, down from 32 percent a year ago. In healthier housing markets, they typically make up at least 40 percent of buyers.

First-time buyers are having trouble qualifying for loans because many banks have adopted tougher lending restrictions and higher down-payment requirements since the housing bubble burst.

In their place, investors and Americans willing to pay cash are playing an outsize role in sales. Cash purchases made up 33 percent of September’s sales, up from 28 percent a year ago.

Borrowing rates began to rise in May after Federal Reserve Chairman Ben Bernanke suggested that the Fed could start to slow its monthly bond purchases by the end of the year. The purchases are intended to keep interest rates low and stimulate the economy.

But the Fed decided against slowing its purchases at its September meeting, citing weak economic data and looming budget battles in Washington. The budget fights led to a partial government shutdown Oct. 1. The nation’s borrowing limit was increased, but only at the last minute. Economists have cut their forecasts for growth in the October-December quarter by about a half-percentage point because of the shutdown and debt-limit fight.

As a result, many economists think the Fed won’t slow its bond purchases until January or even later. That’s likely to keep mortgage rates low well into the new year.

Information for this article was contributed by Christopher S. Rugaber of The Associated Press and Lorraine Woellert and Chris Middleton of Bloomberg News.

Business, Pages 21 on 10/22/2013