More than 2,800 homes were sold in Arkansas in August, a good deal more than in 2012 and the most since August 2007 - four months before the country fell into a recession, the Arkansas Realtors Association said Tuesday.

Sales were up almost 24 percent compared with August 2012, the biggest increase since a 25 percent jump in April 2010 when home buyers were rushing to beat a federal deadline to receive a tax credit.

“If there was any doubt remaining, this clarifies that we’re seeing a recovery in the residential real estate market in Arkansas,” said Michael Pakko, chief economist at the Institute for Economic Advancement at the University of Arkansas at Little Rock.

Nationally, sales of previously owned homes rose in August to a seasonally adjusted pace of 5.5 million, the National Association of Realtors said. It was the fastest pace for annual home sales in more than six years, the association said.

The data for Arkansas are based on sales by Realtors of previously owned and newly built homes in 43 counties that include the most populated ones.

Kathy Deck, director of the Center for Business and Economic Research at the University of Arkansas at Fayetteville, called August “a monster month” for home sales in Arkansas.

There were several reasons for the jump, Deck said.

Job growth has driven the increase in sales, particularly in Northwest Arkansas, but also in the Fort Smith and central Arkansas areas, Deck said. Job growth goes a long way to spur the housing market, Deck said.

“Northwest Arkansas is on fire from a job-gain perspective,” Deck said. “Job growth leads to housing growth, which leads to construction growth, which leads to job growth.”

Northwest Arkansas has added almost 11,000 jobs from August last year to August this year. The unemployment rate in the Fayetteville-Springdale-Rogers metropolitan area has remained below 6 percent since July 2012.

There are more than 800 people a month being added to the population of Benton and Washington counties every month, including births, Deck said. That’s less than the booming pace before the recession of more than 1,000 a month, but it’s still incredible growth, she said.

“It’s good to see the economic engine firing again,” Deck said.

Interest rates increased slightly in the summer months before a recent decline, so that is a motivator for people to enter the home-buying market while interest rates remain attractive, Deck said.

“And then, of course, good housing market news leads to more good housing news,” Deck said. “It’s a cycle there when people aren’t worried about buying their home and then it losing value immediately, they’re more likely to buy. So we’re in a place where housing is contributing in a good way to where the economy is headed.”

The interest rate for a 30-year fixed mortgage is up to about 4.25 percent, said Scott McElmurry, chief executive officer of Bank of Little Rock Mortgage. The 15-year mortgage is about 3.75 percent, McElmurry said.

The housing recovery has been long anticipated, Pakko said.

“Last year and 2011 were both very slow years,” Pakko said. “I wasn’t surprised to see 2011 rather slow, but I was expecting to see the pace pick up in 2012 and was a bit surprised that we didn’t see it.”

The environment is still very positive for buying and financing a home, Pakko said. Mortgage rates are still at historically low levels, he said.

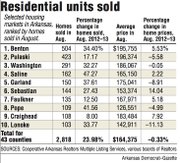

In August, Benton County saw the most sales of any county in Arkansas, 504, well above Pulaski County, the state’s most populous county, which had 423 sales. The average home price in the state was $164,375, basically unchanged from August last year.

For the first eight months of the year, home sales are up 12.7 percent compared with the same period last year. There have been 18,339 homes sold in Arkansas through August compared with 16,267 through eight months last year.

Through eight months this year, Benton County Realtors have sold 3,130 homes, 105 more than in Pulaski County for the same period.

Deck and Pakko both said they believe home sales this year have a good chance at finishing more than 10 percent above sales last year.

Even with an expected drop in sales in the normally slow final months of the year, there should be about 26,000 homes sold in Arkansas this year, which would be the most since 2007, Pakko said.

McElmurry warned, however, that an extended federal government shutdown could hurt home sales.

One loan program that is already shut down now is for rural development loans, McElmurry said.

Those loans at times account for 10 percent of the mortgages Bank of Little Rock Mortgage handles in a month, McElmurry said.

“And if there is a protracted government shutdown, you may see contracts that were scheduled to close in October not close until November,” McElmurry said.

Front Section, Pages 1 on 10/09/2013