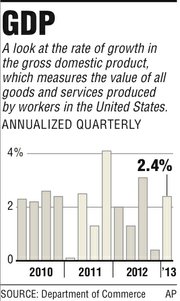

WASHINGTON - The U.S. economy grew at a modest 2.4 percent annual rate from January through March, the Commerce Department said Thursday, slightly slower than initially estimated.

Consumer spending was stronger than first thought, but businesses restocked more slowly and state and local government spending cuts were deeper.

The first-quarter revision was only marginally below the 2.5 percent annual rate the government had estimated last month. That’s still much faster than the 0.4 percent growth during the October-December quarter.

“The private economy in the U.S. is still pretty strong,” said Nariman Behravesh, chief economist at IHS Inc. in Lexington, Mass., who correctly projected the GDP revision. “We seem to have dodged a lot of bullets. The worst of the sequester is behind us and we avoided the fiscal cliff. Yes, taxes were up, but it doesn’t seem to have had a huge negative effect.”

Most economists think growth is slowing to around a 2 percent annual rate in the April-June quarter as the economy adjusts to federal spending cuts, higher taxes and further global weakness.

Jennifer Lee, senior economist at BMO Capital Markets, said the small revision to first-quarter growth supported her view that the economy will grow a moderate 2.2 percent for the year, the same as last year.

Lee said she expects growth to improve to 3.2 percent in 2014, as the job market accelerates and consumers grow more confident in the economy.

Consumer spending accounts for 70 percent of economic activity as measured by the gross domestic product. GDP is the economy’s total output of goods and services, from haircuts and computers to trucks and aircraft carriers.

The government’s second look at first-quarter growth showed that consumer spending roared ahead at a 3.4 percent annual rate. That’s the fastest spending growth in more than two years and even stronger than the 3.2 percent rate estimated last month.

Healthy consumer spending shows many Americans are shrugging off smaller paychecks that started Jan. 1 with the end of a temporary break in Social Security taxes.

And more consumer demand also could prompt businesses to restock at a faster rate later this year. Business inventories grew in the first quarter but at a slightly slower pace than first estimated. That was a key reason for the small revision.

One reason consumers have withstood the higher tax rate is that the job market has been slowly improving. Employers have added an average of 208,000 jobs a month since November. That’s well above the monthly average of 138,000 during the previous six months.

More Americans filed claims for unemployment insurance payments last week as Memorial Day closures prevented five states from completing a full count.

Applications for jobless benefits increased 10,000 to 354,000 in the week that ended Saturday, the Labor Department said Thursday. Two states, Virginia and Wyoming, provided their own estimates last week, and the Labor Department issued projections for Hawaii, Minnesota and Oregon, a government spokesman said.

Dismissals have been waning as employers hold on to workers to meet sales, helping to pave the way for a pickup in hiring once companies see demand accelerate.

Surging stock prices and home-price increases also have allowed Americans to regain the $16 trillion in wealth they lost to the recession. Higher wealth tends to embolden people to spend more. Some economists have said the increase in home prices alone could spur consumer spending enough to offset the Social Security tax increase.

The recovery of the housing market has been driving the overall economy, but fewer Americans than forecast signed contracts in April to buy previously owned homes, the National Association of Realtors said Thursday.

The index of pending home sales rose 0.3 percent after a 1.5 percent gain in March.

Growth in the labor market and cheaper borrowing costs are sustaining housing demand, showing residential real estate will remain a source of strength for the economy. Rising property values may encourage more Americans to put their homes on the market and help increase the number of available dwellings.

“We’ve got pent-up demand out there from people who put off purchasing a home, affordability remains very high,” said Gus Faucher, a senior economist at PNC Financial Services Group Inc. in Pittsburgh. “Housing is, and will be, an important driver of overall economic growth through the rest of 2013 and into 2014.”

The weakest area of the economy continues to be government spending, which fell for the 10th time in the past 11 quarters. The 4.9 percent rate of decline was even larger than first estimated, reflecting further drops in defense spending and weaker activity at the state and local level.

And with the federal government furloughing workers and trimming other spending to meet the mandates of the sequester, government activity will be a drag on growth for the rest of the year.

The housing recovery continued to add to growth at the start of the year. Home construction, one of the economy’s top performers, grew at an annual rate of 12.1 percent in the first quarter, its third-consecutive quarter of double-digit growth.

Businesses, however, reduced the pace of their investment in equipment and computer software. That slowed to a growth rate of 4.6 percent in the first quarter, down from growth of 11.8 percent in the fourth quarter.

Information for this article was contributed by Martin Crutsinger of The Associated Press and by Shobhana Chandra, Alex Kowalski and Jeanna Smialek of Bloomberg News.

Front Section, Pages 1 on 05/31/2013