WASHINGTON - U.S. factory activity expanded at a slower pace in April, held back by weaker hiring and less company stockpiling.

The Institute for Supply Management said Wednesday that its index of manufacturing activity slipped to 50.7 last month. That’s down from 51.3in March and the slowest pace this year. A reading above 50 indicates expansion.

A measure of hiring fell sharply to 50.2, the lowest level since November. That suggests factories cut jobs again in April. And manufacturers cut back on stockpiling for the second-straight month.

The Institute for Supply Management’s employment gauge hasn’t been a reliable indicator in recent months: It reached a nine-month high in March, conflicting with government data that reported factories shed 3,000 jobs.

“Manufacturing is stalling a bit,” said Jim O’Sullivan, chief U.S. economist at High Frequency Economics Ltd. in Valhalla, N.Y. “Part of it is an inventory correction and part of it is the impact from fiscal tightening. The second quarter is looking pretty sluggish.”

In a separate report Wednesday, the Commerce Department said spending on U.S. construction projects fell in March as the biggest drop in government projects in more than a decade overwhelmed strength in home building.

Construction spending fell 1.7 percent in March, compared with February. It marked the second decline in the past three months. January activity plunged a record 4 percent, which represented a downward revision from a previous estimate of a 2.1 percent decline.

The weakness in government activity occurred at all levels. Spending by state and local governments was down 4.2 percent while spending by the federal government on construction projects was down 1.7 percent. Economists are expecting federal activity to be reduced in coming months as different agencies cope with across-the-board spending cuts that went into effect March 1.

Despite the decline in the pace of growth, economists said the Institute for Supply Management’s survey still shows that manufacturing expanded for the fifth-straight month. And there were some positive signs in the report.

A measure of production and new orders rose. More new orders indicate companies may have to rebuild their stockpiles in the coming months. Order backlogs grew at a faster pace. Higher orders points to more factory output in the coming months.

“This is not a slump, just more slow growth,” John Silvia, chief economist at Wells Fargo Securities, said.

Still, slower growth in manufacturing suggests some companies may be worried about government spending cuts.

The decline follows a report last week that said businesses slowed their investment in facilities and equipment in the first quarter.

A recession in the 17 European Union countries that use the euro and weaker global growth threaten demand for U.S. exports. A measure of export orders in the Institute for Supply Management survey grew at a slower pace in April.

Factories may also see slower sales this spring because consumers are starting to feel the impact of higher Social Security taxes. Americans increased their spending from January through March at the fastest pace in more than two years. But spending on goods fell in March, a sign that the tax increase may be catching up with consumers.

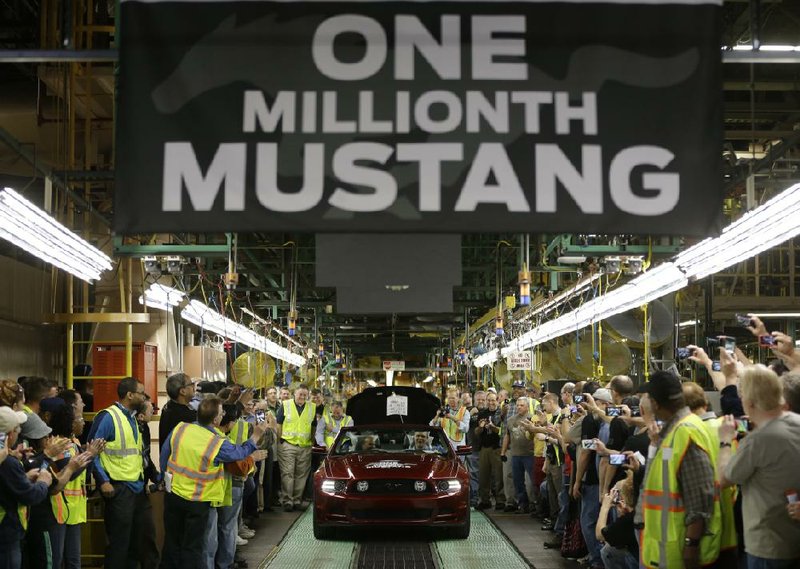

One area of manufacturing that remains strong is auto production: Ford, GM, Chrysler and Nissan all reported double-digit U.S. sales increases last month, signaling the best April for car and truck sales in six years.

Still, factories cut jobs in March after five months of hiring. And manufacturing output declined in March, the Federal Reserve said last month, despite a jump in auto production.

The economy grew at an annual rate of 2.5 percent from January through March, the government said last week. That was an improvement from the anemic growth of 0.4 percent in the final three months of last year. Most economists expect growth will slow in the current quarter and remain subpar for most of the year.

Companies added fewer workers than forecast in April, an indication the labor market has cooled along with the rest of the U.S. economy.

The 119,000 increase in employment, the smallest since September, followed a revised 131,000 gain in March that was smaller than initially estimated, figures from the Roseland, N.J.-based ADP Research Institute showed Wednesday.

By hiring fewer employees, companies are signaling they expect demand will deteriorate as reductions in the federal budget and higher taxes weigh on the U.S. economic expansion. At the same time, a Labor Department report later this week is projected to show private payrolls rose by 160,000 last month, according to the Bloomberg survey median.

“Job growth appears to be slowing in response to very significant fiscal headwinds,” Mark Zandi, chief economist at Moody’s Analytics Inc., said in a statement. Moody’s produces the figures with ADP. “Tax increases and government spending cuts are beginning to hit the job market. Job growth has slowed across all industries and most significantly among companies that employ between 20 and 499 workers.” Information for this article was contributed by Christopher S. Rugaber and Martin Crutsinger of The Associated Press and by Shobhana Chandra and Alex Kowalski of Bloomberg News.

Business, Pages 23 on 05/02/2013