More homes were sold in Arkansas last month than in any month in the past three years, the Arkansas Realtors Association said Friday.

There were 2,515 homes sold in May in the 43 counties surveyed by the association, the most since May 2010, when 2,524 were sold.

May 2010 was the aftermath of the federal government’s homebuyer tax credits, which temporarily increased home sales, said Michael Pakko, chief economist at the Institute for Economic Advancement at the University of Arkansasat Little Rock.

“That was an extraordinary situation,” Pakko said.

Homes sales in the state also were up 10 percent last month compared with May last year, when 2,286 homes were sold.

The 10 percent increase over May last year also was impressive, Pakko said.

“May last year was not a weak month,” Pakko said. “It was actually the second-highest sales month of the year. So this is a 10 percent gain on what was, by last year’s standards, a fairly strong month.”

Sales in the metropolitanareas in the state also are doing well, Pakko said.

“We had seen signs of strength in the Northwest Arkansas market earlier this year,” Pakko said. “But as I checked on the key counties in all the state’s metropolitan areas, they are all showing strong gains.”

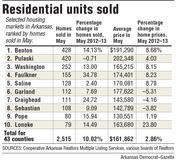

For the first five months of the year, sales are up 18 percent in Washington County, 17 percent in Benton County, 14 percent in Craighead County and 10 percent in Sebastian County.

Sales are only up 4 percent for the year in Pulaski County, but in the other main counties of the metropolitan area, sales are up significantly for the year - 27 percent in Faulkner County, 13 percent in Lonoke County and 12 percent in Saline County.

Even sales in Jefferson County, which has one of the weaker economies in the state, are up 4 percent for the year.

Home prices in the state averaged $161,862 in May, upalmost 3 percent compared with a year earlier.

“The fact that we’ve seen continued increases in prices month after month shows that they wouldn’t be rising if there wasn’t some demand out there,” Pakko said. “Prices have clearly bottomed out and are on the upswing. That should be a factor of stability for both buyers and sellers.”

Mortgage rates have increased in the past month, said Scott McElmurry, chief operating officer at Bank of Little Rock Mortgage.

Rates for a 30-year fixed mortgage are about 4.25 percent, McElmurry said, up from about 3.5 percent as recently as three weeks ago. A 15-year fixed rate mortgage is about 3.5 percent, McElmurry said.

Part of the reason for the increase in home sales is the improved economy, McElmurry said.

“And part of it could be the knowledge that rates are still low,” McElmurry said. “I don’t think that the recent rise in interest rates is going to stifle demand much. They are still historically low.”

Front Section, Pages 1 on 06/29/2013