More than 100,000 Arkansans will share in almost $3.5 million in rebates from health-insurance companies - an average of $49 per household - as a result of a provision in the 2010 federal health-care overhaul law, a federal agency announced Thursday.

For plans covering individuals and small businesses, the Patient Protection and Affordable Care Act requires insurance companies to spend at least 80 percent of the premiums on medical care or other patient health initiatives, rather than on salaries and administrative expenses.

Plans covering larger employers, defined in Arkansas as those with 51 or more covered employees, must allocate at least 85 percent of collected premiums for medical care.

If the administrative expenses are higher than allowed, the insurance companies must issue rebates to customers. For example, an insurer that spent 78 percent of its premiums for individual plans on medical care in 2012 - falling short of the required ratio by 2 percent - would issue each custom-er with an individual plan a refund equal to 2 percent of the premium the customer paid that year.

The rebates can be paid directly to policyholders or through credits toward future premiums.

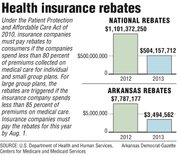

The rebate total is less than half of the nearly $7.8 million insurance companies paid in rebates last year, the first year the requirement took effect.

Nationally, rebates fell by a similar percentage, from $1.1 billion last year to $504 million this year. Companies must pay the rebates, which are calculated based on premiums and expenses from the previous year, by Aug. 1.

Large companies that fund their own insurance plans are not subject to the requirement.

In Arkansas, the largest rebate total - just over $2 million - will be paid by Minnetonka, Minn.,-based United Healthcare. That includes $745,358 that will go to the 9,400 people covered by plans from its Golden Rule Insurance Co. subsidiary; $550,785 to 22,000 people covered by its small group policies; and $743,760 to 20,000 people covered by its large-group policies.

A spokesman for United Healthcare didn’t return a call seeking comment.

Arkansas Blue Cross and Blue Shield, the state’s largest insurer, owes $887,507 to the more than 58,000 people covered by its plans for small businesses.

That’s down from the $5.2 million the company owed to people covered under the policies last year.

Company spokesman Max Greenwood noted that the rebate will be an average of less than $2 per month, or about $24 for the year, for each of the 37,000 households covered by one of the plans.

She said the company tried to meet the required 80 percent ratio.

“We obviously thought we were going to meet it, but then at the end of the year, the claims just weren’t what we expected,” Greenwood said.

The company met the required ratio for its individual and large-group plans.

The other insurance companies that will issue rebates are Bloomfield, Conn.,-based Cigna, which will pay $447,867 to the 1,100 people covered by its large-group plans, and the North Richland Hills, Texas-based MEGA Life and Health Insurance Co., which will pay $119,286 to the 1,000 people covered by its individual plans.

MEGA spokesman Donna Ledbetter said in an e-mail that the company spent 76.1 percent of its premiums on medical expenses in 2012.

“We believe our percent of premium rebate demonstrates we are utilizing sound actuarial pricing practices for our plans,” she said.

A Cigna spokesman didn’t return a call seeking comment.

Little Rock-based Qual-Choice, which covers about 25,000 people in its individual and employer-based plans, met the required spending ratios and will not have to issue refunds.

The rebate requirement will apply to health-insurance plans sold through exchanges being set up in every state under the health-care law.

Under the expansion of Medicaid approved by the Legislature during this year’s session, about 250,000 people with incomes of up to 138 percent of the poverty level will be able to sign up for one of the plans starting Oct. 1 and have their premiums paid by Medicaid.

Any rebates issued by a plan covering a Medicaid recipient would likely go to the Medicaid program, said Amy Webb, a spokesman for the state Department of Human Services.

The U.S. Department of Health and Human Services’ Centers for Medicare and Medicaid Services said the drop in required rebates shows that companies are keeping premiums lower and operating more efficiently. In addition to receiving rebates, the agency, said consumers saved $3.4 billion on their premiums because insurance companies did a better job of meeting the required spending ratio.

“The health care law is providing consumers value for their premium dollars and ensuring the money they pay every month to to insurance companies goes toward patient care,” Health and Human Services Secretary Kathleen Sebelius said in a news release.

Premiums didn’t fall, however. Last year, premiums nationwide rose an average of 3 percent for single coverage and 4 percent for family coverage, according to the Menlo Park, Calif.,-based Kaiser Family Foundation.

With the growth of healthcare spending slowing, Michael Tanner, a senior fellow with the libertarian Cato Institute in Washington, D.C., said the drop in rebates was likely because of a reduction in the insurance companies’ administrative spending, including customer service.

He called the rebates an “arbitrary” way to reduce customers’ costs.

“If you squeeze administrative costs enough, you’re going to squeeze out a lot of fat and waste, but you’re also going to find when you call up to get information, you’re on hold for two hours and sent to a call center in Mumbai,” Tanner said.

Clare Krusing, a spokesman for America’s Health Insurance Plans, a trade association representing the insurance industry, said the rebate requirement “does nothing to address the main drivers of health-care costs and puts an arbitrary cap on what health plans spend on a variety of programs and services that improve the quality and safety of patient care.”

Front Section, Pages 1 on 06/21/2013