SAC Capital Advisors LP, the $14 billion hedge fund founded by Steven Cohen, was indicted Thursday on accusations that it perpetrated what prosecutors called an unprecedented insider-trading scheme.

The scheme was revealed as part of the government’s six-year crackdown on Wall Street crime.

The Stamford, Conn .-based firm was charged with four counts of securities fraud and one count of wire fraud in an indictment unsealed in Manhattan federal court. The purported scheme, which involved more than 20 companies and went back as far as 1999, helped reap hundreds of millions of dollars in illicit profits, prosecutors said.

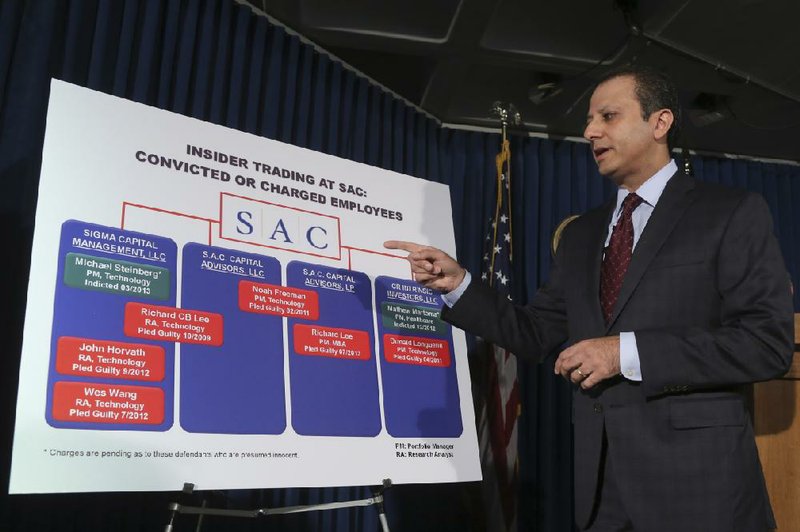

“When so many people from a single hedge fund have engaged in insider trad-ing, it is not a coincidence,” Manhattan U.S. Attorney Preet Bharara said. “Today’s indictment is not just a narrative of names and numbers, it is more broadly an account of a firm with zero tolerance for low returns but seemingly tremendous tolerance for questionable conduct,” he said. “So SAC, over time, became a veritable magnet for market cheaters.”

While he declined to comment on the possibility of charges against Cohen, Bharara said the investigation was “ongoing.” He also said the government isn’t “restraining” SAC assets.

“I’m not going to say what tomorrow may or may not bring,” he said at a news conference Thursday in New York.

The charges came less than a week after federal regulators accused Cohen in a related civil case of failing to prevent insider trading at the firm. While the Justice Department’s action targets SAC but not Cohen directly, the civil case brought by the Securities and Exchange Commission seeks to effectively shut him down by barring him from managing investor funds.

Regulators were looking at Cohen as early as nearly three decades ago. The SEC questioned Cohen in 1985, asking questions about whether he traded RCA Securities stock based on inside information.He asserted his Fifth Amendment right against self-incrimination and refused to answer questions, according to a transcript obtained via the Freedom of Information Act. Cohen was never accused of wrongdoing in the case.

The Justice Department has been wary of filing criminal cases against corporations in recent years, mindful that prosecution led to the death of giant accounting firm Arthur Andersen, which was Enron’s auditor. The firm’s demise resulted in thousands of lost jobs.

But in the wake of the financial crisis, critics complained that the Justice Department was too afraid to file cases against major Wall Street firms and executives. Top law-enforcement officials have tried to fend off accusations that some are simply “too big to jail.”

Insider trading, however, did not cause the financial crisis, and SAC Capital lacks the global reach of a major bank. But the multibillion-dollar fund nevertheless has an outsize presence on Wall Street and its prosecution could cause economic collateral damage in the New York area.

SAC Capital employs about 1,000 people and generates enormous trading revenue for other firms.

In the Thursday indictment, the government said that SAC’s insider trading was “made possible by institutional practices that encouraged the widespread solicitation and use of illegal inside information. Unlawful conductby individual employees and an institutional indifference to that unlawful conduct resulted in insider trading that was substantial, pervasive and on a scale without known precedent in the hedge fund industry.”

In a statement, Jonathan Gasthalter, a spokesman for the hedge fund, said the “handful of men” implicated in wrongdoing at the firm doesn’t reflect on its other employees. “SAC has never encouraged, promoted or tolerated insider trading and takes its compliance and management obligations seriously,” Gasthalter said.

In a second statement Thursday, Gasthalter said the charges won’t “affect the ongoing operations of SAC’s business, prevent investor redemptions, or impact the interests of any of SAC’s counterparties.”

An initial hearing in the case is scheduled for today before U.S. District Judge Laura Taylor Swain in Manhattan.

There was no unusual price movement or volume in stocks Thursday where SAC Capital holds the biggest percentage of shares outstanding. Banks including Deutsche Bank AG and New York-based Goldman Sachs were debating whether to suspend doing business with the hedge fund, which has been one of Wall Street’s biggest trading clients, according to two people briefed on the matter.

Spokesmen for the biggest Wall Street banks declined to comment on whether they had reached a decision.

While Cohen, 57, wasn’t charged in the indictment,prosecutors described him as “the fund owner” and said he “encouraged” SAC employees to obtain trading information from company insiders while ignoring indications that it was illegal.

The U.S. described separate insider-trading schemes by at least eight former SAC fund managers and analysts, including Noah Freeman, Donald Longueuil, Jon Horvath, Wesley Wang, Mathew Martoma, Richard Choo-Beng Lee and Michael Steinberg.

Prosecutors added an additional SAC fund manager to the roster Thursday, saying that Richard Lee, a former SAC portfolio manager who worked at the firm until March 2013, pleaded guilty to insider-trading charges Tuesday. His lawyer said he’s cooperating with the U.S.

Prosecutors said Richard Lee focused on “special situations” including mergers and acquisitions, private-equity buyouts corporate restructurings in publicly traded companies.

Martoma and Steinberg, who are charged with engaging in separate insider-trading schemes in 2008, have both pleaded innocent and face trial in November.

Freeman, Horvath and Wang have pleaded guilty to federal securities fraud charges and are cooperating with the U.S. Longueuil pleaded guilty to insider trading but isn’t cooperating.

The U.S. alleged SAC’s fund owner traded after getting what prosecutors said was nonpublic information from an analyst in late August 2008. Prosecutors said the fund owner sold his entireposition, about $12.5 million in Dell Inc., after receiving a tip from Horvath that the computer-maker was about to announce disappointing quarterly earnings.

SAC employed practices that encouraged its portfolio managers and research analysts “to pursue industry contact networks to obtain an information ‘edge’ unavailable to other investors, without effective corresponding controls to prevent that ‘edge’ from consisting of inside information,” the indictment said.

SAC’s owner “fostered a culture that focused on not discussing inside information too openly, rather than not seeking or trading on such information in the first place,” the U.S. alleged.

The fund hired Richard Lee, who had a reputation of working at an “insider trading group” while working as a portfolio manager at another hedge fund, the U.S. alleged. That fund was Citadel LLC, according to a person familiar with the matter who asked not to be identified because the matter is private.

Lee, who went on to manage a $1.25 billion portfolio at SAC, pleaded guilty to conspiracy and securities fraud, the U.S. said. Lee admitted that in 2009, he got advance information about Yahoo Inc. and 3Com Corp., generating more than $1.5 million in profits, according to a related Securities and Exchange Commission complaint.

“Richard Lee has accepted responsibility for his prior conduct and is cooperating with the government and looks forward to moving past this episode in his life,” said Lee’s lawyer, Richard Owens, a partner at Latham & Watkins LLP.

Citadel said Thursday in a statement that Lee was employed there between January 2006 and April 2008.

“Citadel does not have, and never has had, an ‘insider trading group,’” the company said in its statement. “Citadel has strict rules against, and oversight designed to prevent, insider trading.” Information for this article was contributed by Patricia Hurtado, Christie Smythe and David Glovin of Bloomberg News; by Andrew Tangel of the Los Angeles Times; and by Larry Neumeister of The Associated Press.

Front Section, Pages 1 on 07/26/2013