Arkansas officials need to know if the state’s nearly $300 million surplus is a one-time fluke before lawmakers decide to cut taxes or increase spending, Gov. Mike Beebe said Tuesday when he announced the final general revenue figures for fiscal 2013.

Arkansas took in $5.027 billion during the 2013 fiscal year, which ended Sunday. That’s $299.5 million, or 6.3 percent, more than budgeted.

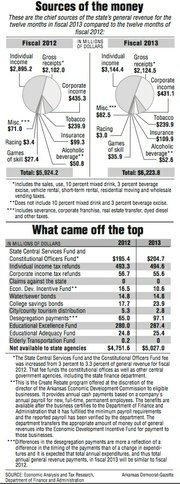

In total the state took in $6.2 billion for the fiscal year, but about $1.2 billion is taken off the top for income tax refunds, economic development and central services such as the governor’s office and the Department of Finance and Administration. The “net” amount left is what state agencies can spend.

In large part, the surplus comes from increased collection of individual income taxes. For the year, Arkansas collected $249.2 million more than forecast for about $3.144 billion total. Corporate income tax collections came in $11.9 million (2.7 percent) less than forecast.

Beebe and leaders of the state Department of Finance and Administration have said for months that income tax collections would be much higher than forecast because some people rushed to pay their taxes before changes to federal tax law went into effect.

“Bottom line here is this is good news but it’s not nearly as good news as the raw numbers would suggest,” Beebe said.

He said the department needs to determine how much money was brought in because of the one-time anomaly before anyone plans to cut taxes or spend the funds. During the 2013 legislative session, lawmakers cut millions in taxes and had wanted to cut more. Several programs weren’t funded during the session, such as scholarships for children of police officers who died in the line of duty.

State Finance Director Richard Weiss said he is cautious about the increased income tax collection in fiscal 2013. He said it means either less in income taxes to collect in fiscal 2014 or that there could be large refunds later in the calendar year that offset the gain.

The state’s chief economic forecaster, John Shelnutt, said it could be months before the department knows how much of the increase came from people paying taxes early and how much was regular economic growth from more people working.

He said the department will watch income-tax collections over the next few months and compare them with the first four months of the 2013 calendar year to get a better picture.

The department has to update the fiscal 2014 budget before the 2014 fiscal session.

“We hope to have a better answer by then,” Shelnutt said.

The department will also watch tax collections in other states over the next few months, he said.

Shelnutt said the federal tax law changes and the early payments as a result led to similar increases with other states that have an income tax, including Mississippi, Pennsylvania and West Virginia.

“It’s not just a unique thing to Arkansas,” Shelnutt said.

Regardless of the amount, lawmakers and the governor will weigh in next winter during the fiscal session about how to spend the surplus, Beebe said.

Beebe said what’s left of the surplus could go to capital needs around the state or rainy day funds, perhaps for specialized scholarships that weren’t funded during the session.

“All of this creates potential options to solve some of those problems going forward. We’ll have to wait and see, but we’ll be back in February with a budget session,” Beebe said. “This is good news, potentially good news.”

Sales-tax collections for the fiscal year came in 1.4 percent ($29.5 million) below the $2.15 billion forecast. May was the only month of the fiscal year that brought in the forecasted amount or above.

Beebe said that tempers some of the excitement about increased income tax collections. Sales tax increases show people are buying more, while income tax collection increases show more people are working, he said.

“The sales tax is relatively flat to forecast. That causes me to be cautious,” Beebe said.”You balance your caution about the sales-tax numbers with your optimism about the withholdings.”

According to the department, June’s revenue came in $11.7 million or 1.9 percent higher than forecast to $621.4 million.

The month’s general revenue collection was a new high for the state, Finance Department Analyst Whitney McLaughlin said.

Other collections include:

A $31.6 million (12.5 percent) increase in income-tax collections over June 2012 to $285.4 million. That is $23.8 million (9.1 percent) above forecast.

A $10.1 million (12.4 percent) decrease in corporate income-tax collections over June 2012 to $71.7 million. That is $11.1 million (13.5 percent) below forecast.

A $1.3 million increase (6.5 percent) in tobacco-tax collections over the same month a year ago to $20.8 million.

Front Section, Pages 1 on 07/03/2013