LITTLE ROCK — Hormel Foods, which makes Spam and other cured, smoked and delicatessen meats, said Thursday that it has agreed to buy Unilever’s Skippy peanut butter division for $700 million.

Unilever’s only American manufacturing plant for Skippy is in Little Rock, where it employs 153 people.

“Hormel Foods intends to maintain current operations at the plant in Little Rock and welcomes the employees there to the Hormel Foods team,” said Alaina Freeman, a spokesman for Hormel.

Asked about possible expansion of the plant or a change in workers’ wages, Freeman repeated that Hormel “intends to maintain current operations at the plant.”

Hormel stock closed at $33.20 Thursday, up $1.19 in trading on the New York Stock Exchange.

Unilever announced in October that it was considering the sale of Skippy.

Introduced in 1932, Skippy is the No. 2 peanut butter brand in the United States, behind Jif, produced by The J.M. Smucker Co.

Skippy is the leading brand of peanut butter in China. Aside from Little Rock, the only other Skippy manufacturing plant is in Weifang, a city in eastern China between Beijing and Shanghai.

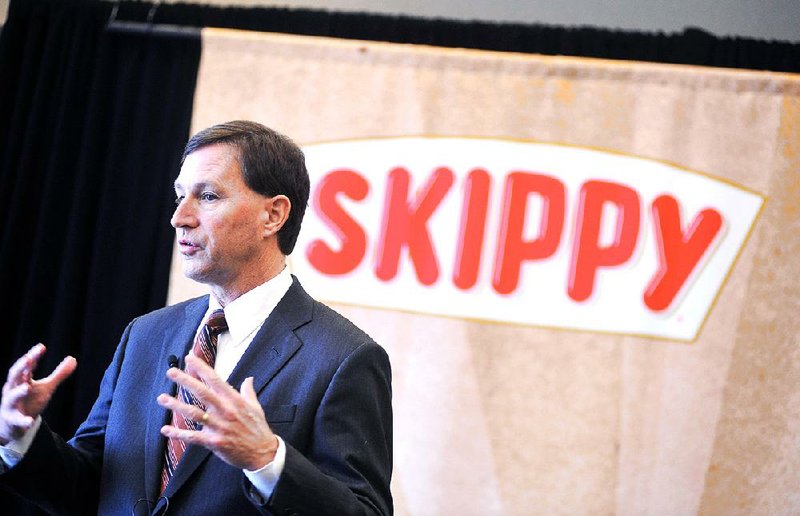

“We feel this transaction will enhance our balance business model in a number of ways,” Jeffrey Ettinger, Hormel’s chief executive officer, said Thursday during a conference call with analysts. “First it adds a significant and valuable new franchise to our grocery products and all our other international segment.”

Skippy has annual sales of about $370 million, including about $100 million in international sales.

In the United States, Skippy fits easily in Hormel’s grocery portfolio, where it will become one of Hormel’s biggest brands, Ettinger said.

Skippy’s presence in China also was an attraction for Hormel, which is based in Austin, Minn. China has been a focus for Hormel for more than a decade, Ettinger said.

“Peanut consumption is high, and peanut oil is a staple of Chinese cooking,” Ettinger said. “Peanut butter has a relatively low current household penetration level, but it is growing rapidly. We think there are great opportunities to catch the wave of growth in that market.”

Skippy also has a high volume of sales in Canada, as well as sales in more than 30 countries on five continents and “will expand our global” presence, Ettinger said.

Hormel also expects to improve Skippy’s business in the United States, Ettinger said.

“I think when we turn our innovation skills loose on this brand that we’re going to find ways to make the Skippy name usable on other types of products,” Ettinger said.

Swings in peanut butter prices have made growth volatile in recent years, but Skippy sales on average have increased about 4 percent annually, a Unilever spokesman said.

Other Hormel brands include Jennie-O Turkey products and Dinty Moore beef stew.

Hormel expects the Skippy purchase — the largest in its history — to close in two parts, this summer in the U.S. and by the end of the year in China.

Unilever, with headquarters in the United Kingdom and The Netherlands, bought Bestfoods, the maker of Skippy, in 2000.

Unilever sold its P.F. Chang’s and Bertolli frozen-meals businesses to Conagra last year for $267 million. Conagra said it will spend $100 million and add 80 jobs at its Russellville plant to handle the brands’ frozen meal product lines.

Information for this article was contributed by Candice Choi and Michelle Chapman of The Associated Press.

Front Section, Pages 1 on 01/04/2013