Property taxes generated in a tax increment financing district would be sufficient to pay for a city of Little Rock-approved $2.69 million bond issue needed for infrastructure work in the Gateway Town Center, a feasibility study concludes.

In 2003, the city granted the 176.4-acre Gateway project status as a tax increment financing, or TIF, district, meaning that some of the increased revenue from property taxes within the development district could be used for infrastructure construction.

The Little Rock Board of Directors will take up an ordinance to allow the proposed bond issue on Tuesday.

The required feasibility study filed with the plan says the numbers work. And so the study - carried out by the University of Arkansas at Little Rock’s Institute for Economic Advancement and commissioned by the Hodges Group - leaves out a tentative third phase’s projected revenue from sales and enhanced property tax revenue.

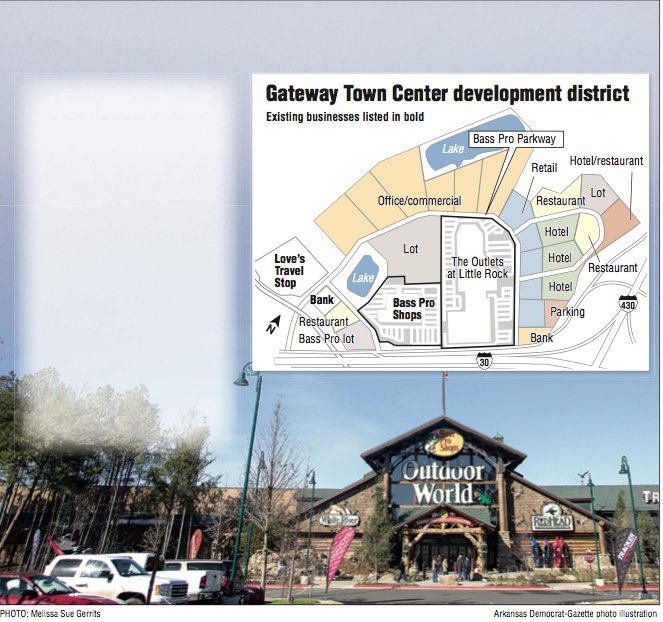

The first phase of the Gateway Town Center, at the intersection of Interstates 30 and 430, was completed when The Bass Pro Shops opened Nov. 13. Five days later, a plan for The Outlets at Little Rock was filed with the city Planning Department. That plan is for 80 stores to be built on 30 acres by the summer of 2015. The Planning Commission is to consider the plan on Jan. 9.

The third phase projects revenue from the construction of three hotels, one bank, six retail stores, five restaurants and eight other commercial spaces, though group manager Tommy Hodges says that last phase is at least five years away.

The feasibility study group felt that because the third phase details were less concrete than the other two, the study should be carried out without them, Michael Pakko, the lead author, said in an interview. And so those projections for tax revenue were not included in the analysis.

“If we had found that [plan] was not feasible - and that’s been common for projects of this type in the past - we would have told the client so,” Pakko said.

“In this case, everything seemed to fall well within the parameters of what the statutes required,” said Pakko,who is chief economist at the institute.

The Legislature passed Act 1197 of 2001 to implement Amendment 78 of the state constitution approved by the state’s voters in 2000; it grants authority to cities and counties to create TIF districts.

While the bond issue will pay for Bass Pro Parkway, the major road in the project, the Hodges Group will foot the bill for the rest of the infrastructure, about $5.8 million.

Hodges says he will go ahead with finishing out the infrastructure that will serve all three phases of the development by next fall.

With completion of the project, the city will have an attractive retail center that he says will pull shoppers in from a 75-mile radius, Hodges said.

Pulaski County Assessor Janet Troutman Ward certified that 9 mills of the 46.4 mills set aside for the Little Rock School District can be used in the district. A mill is one-tenth of a cent. Each mill is assessed against each dollar of assessed value and would therefore produce $1 of tax for each $1,000 of valuation.

Tax increment financing districts divert an increase in property-tax revenue that a school system normally would get from property development in that district. Instead, the new revenue goes to pay for improvements that benefit the district itself.

Ward also certified the diversion of 5 mills on the increased value of the property from the Pulaski County General Fund, 1.45 mills from the county road fund, 5 mills from the Little Rock General Fund and 1.45 mills from the Little Rock Road Fund. With the shifting of 9 mills from the School District Fund, the total is 21.9 mills, according to the institute’s study.

The proposed ordinance scheduled to be taken up Tuesday would authorize the city to issue bonds to help pay for the infrastructural improvements.

The feasibility study looks at two scenarios in a “stress test” of the assumptions of the developer’s plans. In one, the property’s value stagnates over the next two decades. In the other, the assumption is that the property was overvalued by 20 percent to start with.

Either way, “projected taxes diverted into the TIF fund are more than adequate to support the repayment of the proposed bond issuance,” the study says.

Pakko said in an interview that “if the development didn’t take place, of course, there would be no tax revenue. So it’s a diversion of future expected revenue to pay for some of the infrastructure now.”

The Hodges Group’s proposal estimates annual sales at Bass Pro Shops at $45 million and at the outlet mall at $65 million.

Annual tax revenue on those sales would amount to $7.15 million going to the state, $1.65 million to the city and $1.1 million to Pulaski County, according to the Hodges Group proposal. (The state sales tax is 6.5 percent, the city’s is 1.5 percent and the county’s is 1 percent.)

However, accepted methods of estimating tax revenue indicate net impact on state revenue to be $645,000 a year, followed by $561,000 for the city and $374,000 for the county, according to the UALR Institute.

Still, those estimates are sufficient to pay off the public bond issue, Pakko said.

Business, Pages 67 on 12/15/2013