VIENNA - Iran hopes to use a meeting of OPEC oil ministers today as a launchpad for its return as a dominant force in global crude markets after months of sanctions. It faces resistance, however, from regional rival Saudi Arabia.

With the 12-nation cartel expected to keep production levels on hold, attention will turn to Iran’s bid to reassert itself in the group. Fresh off a nuclear deal with six world powers, it aims to have international sanctions lifted in six months and is vying to name one of its own to be the Organization of Petroleum Exporting Countries’ secretary-general.

Before the oil sanctions started biting, Iran was second only to the Saudis in OPEC oil production, pumping about 2.7 million barrels a day. It has dropped nearly a third since then.

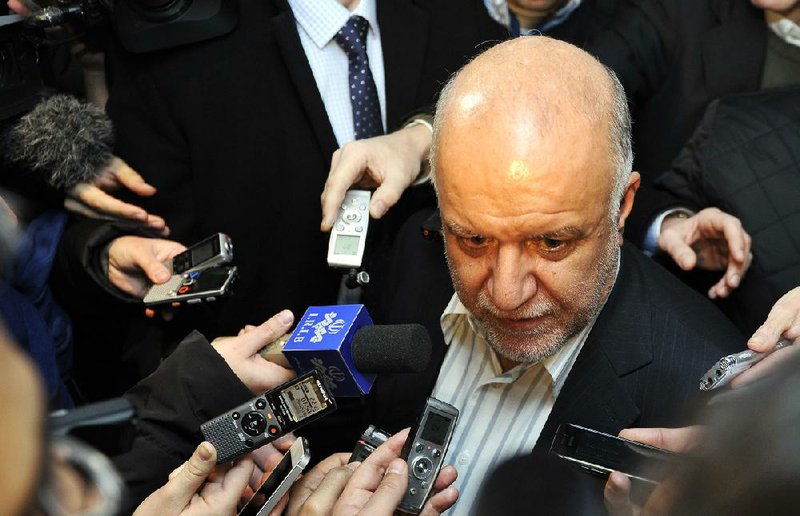

The first-step nuclear deal is intended to turn into a final accord that permanently curbs Tehran’s atomic activities in exchange for full sanctions relief. Tehran’s oil minister, Bijan Namdar Zanganeh, is expected to lobby at today’s meeting for a greater share of total OPEC output next year.

Zanganeh on Tuesday said oil sanctions may be incrementally relaxed even earlier, telling reporters, “I hope we [can] gradually increase our export” as the first-step deal is implemented in the coming months.

In a nod to the Saudis, he said he hoped OPEC members understand that “when a member country comes back … they should open the doors for him and not fight with him.”

Many oil companies are eager to get back into Iran,and Zanganeh said he had meetings with some of them set up while in Vienna. He gave no details, saying, “many eyes are watching us and working against us.”

Saudi Arabia might be hard to persuade. It currently produces close to a third of the daily 30 million barrels that OPEC accounts for. As bitter regional rivals with Iran, the Saudis may not be ready to cede much ground. And with their producing clout they usually make OPEC policy.

The Saudis set the meeting’s direction even before it convened. The Saudis are happy with present prices - well above $100 a barrel for the internationally traded benchmark crude - and comments by Saudi Oil Minister Ali Naimi suggested that the group would keep the overall production target.

“We are at the right price right now,” he said.

Beside the gap left by Iran sanctions, Libyan output is strongly down because of unrest. That leaves a production hole that the Saudis are happy to fill.

“The continuous output issues in Libya … coupled with the Iran sanctions, leaves the Saudi spigot in firm control,” said the “Kilduff Report,” edited by Michael Fitzpatrick.

That could change next year, though, if production from Iran and Libya comes back and Iraq’s remains strong - it already puts out about 3 million barrels a day.

That, as well as strong U.S. shale oil production, will likely increase internal competition, as the three countries jostle for OPEC share.Political tensions could also grow, with Sunni Saudi Arabia vying with Shiite-led Iran and Iraq.

“Not only do they have to deal with rising U.S. production, they have to deal with the fact that they hate each other,” said oil analyst Phil Flynn of the Saudis and Iranians.

All three countries have put forward candidates for the post of OPEC secretary general, who acts as the voice of the organization between meetings. But with their rivalries strong and potentially harmful to OPEC unity, the countries could skirt the issue and extend Libya’s Abdullah Al-Badry’s term for another year.

Business, Pages 25 on 12/04/2013