Legislature checks off 3 priority issues

Leaders’ chasm early on narrows as session wanes

Arkansas House Speaker Rep. Davy Carter, R-Cabot, attends a bill signing ceremony at the Arkansas state Capitol in Little Rock, Ark., Tuesday, April 23, 2013. (AP Photo/Danny Johnston)

Sunday, April 28, 2013

In the longest session in 82 years and the first led by Republicans in more than a century, members of the 89th General Assembly went home last week after passing bills to provide health insurance for more than 250,000 poor Arkansans, cut taxes projected to reduce state general revenue by $235.6 million over the next three fiscal years and allow $125 million in state-backed bonds for a $1.1 billion steel mill.

Lawmakers spent 100 days at the Capitol, making the legislative session the longest since the General Assembly met for 121 days in 1931. Legislators are to return May 17 to formally adjourn the session.

House Speaker Davy Carter, R-Cabot, said it was remarkable that the Legislature addressed all three priority issues.

DATABASE: Arkansas special projects and programs

“Those issues were, in my mind, the most important three things we could get done, and we got them done,” he said. “To have effectively an evenly split [House] chamber and to get this much done, to get this much accomplished, I think is remarkable, and I think it’s a testament to the strong members that are up here.”

Early in the session members tackled more socially conservative topics and overrode vetoes by Gov. Mike Beebe, a Democrat, three times.

Carter said the Legislature didn’t dwell on partisanship, however.

“We had some difficult days. I will say those were very few in the big scheme of things, but on those days people got dressed up and came back the next day and worked together again. Those are things you can be proud of,” Carter said.

‘PRIVATE OPTION’

Lawmakers spent much of the final month of the session wrangling over Act 1498, which creates a program that, if approved by the federal government, would let 250,000 poor Arkansans obtain private health insurance paid for with federal Medicaid dollars. Act 1496 authorizes the Department of Human Services to spend the money.

Many observers thought that providing insurance to this population was a nonstarter after the U.S. Supreme Court ruled in June that states could choose whether to expand Medicaid coverage to their low-income people.

Arkansans who earn up to 138 percent of the federal poverty level would have their premiums paid with Medicaid dollars. (That’s $15,145 per year for an individual with no dependents.)

The plan has been dubbed the “private option.” Poor Arkansans - along with more than 200,000 Arkansans who would pay for their own government-subsidized health insurance - would be able to obtain insurance from private companies on a marketplace called an insurance exchange.

Arkansas is the first state in the nation to approve the “private option” model. Other states have added their low-income populations to traditional Medicaid, more have refused to act at all. Co-sponsor Sen. David Sanders, R-Little Rock, said he and other supporters wanted topush back against the “one size-fits-all” option in the Affordable Care Act, while also addressing the expected effects of the law on the state and private businesses.

“The critical point for us in the Senate, I think, was coming to terms with the options and the cost of the options, both short-term and longterm. Ultimately we were able to come together in the end by making the best decision for the state,” he said.

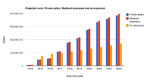

An actuarial study paid for by the state showed that with the private option, Arkansas stands to save $670 million over the next decade because of a drop in the state-subsidized traditional Medicaid rolls, increased premium taxes and a sharp increase in federal funding.

A study by the Jackson Hewitt Tax Service estimated that the expansion saves Arkansas employers up to $38 million in federal fees they would otherwise face ifthey failed to provide health insurance for their workers.

TAX CUTS

The Republican-controlled Legislature enacted a plethora of tax reductions ranging from state income tax rates to capital gains taxes to the sales taxes paid by manufacturers on their use of energy to sales taxes paid on the purchase of timber harvesting machinery and equipment.

In total, 16 measures were enacted that the state estimates will reduce total state tax revenue by $11 million in fiscal 2014, $97.2 million in 2015 and $160 million in 2016.

Most provisions in the tax-cut measures take effect in fiscal 2015 and 2016.

Act 1459, sponsored by Rep. Charlie Collins, R-Fayetteville, is the largest of the tax-cut measures, with the state projecting that it will reduce total tax revenue by $2.5 million in fiscal 2014, $30.4 million in 2015 and $55.7 million 2016.

It phases in a 0.1 percent cut in income tax rates.

An income-tax-rate cut from 1 percent to 0.9 percent on the first $4,099 of net income is the only part of the bill going into effect in the tax year starting Jan. 1.

About 1.2 million individual income-tax payers will benefit from the law, said John Theis, an assistant state revenue commissioner.

The 0.1 percent cuts in the other income tax rates start in the tax year beginning Jan. 1, 2015. At that time, as an example, the 7 percent income tax rate will be reduced to 6.9 percent on net income of $34,000 and above.

Act 1488, sponsored by Carter, is the second-largest of the tax-cut measures, with the state projecting that it will cut total tax revenue by $600,000 in fiscal 2014, $18.1 million in fiscal 2015 and $24.5 million in fiscal 2016.

The law increases the stan-dard deduction from $2,000 to $2,200 starting Jan. 1, 2015, with the finance department projecting that 337,000 people will claim the deduction, according to Theis.

It would increase the existing 30 percent income-tax exemption on capital gains to 50 percent in the tax years starting Jan. 1, 2015. The finance department projects that about 68,500 people will claim the increased exemption, Theis said, adding that capital gains can fluctuate from one year to the next on the basis of several factors, including general economics and personal investment decisions.

It also exempts capital gains exceeding $10 million from a gain on or after Jan. 1, 2014. The finance department projects that 10 or 11 people will be able to claim this provision, said Theis.

“At some point you get where people are just leaving, and, before they incur that transaction, they just pick up and they move to somewhere else and they are gone,” Carter said. “That tax doesn’t get paid now because they just pick up and leave. At least that’s the mind-set.”

Beebe signed Carter’s measure, two years after he voiced concern at a state Democratic Party convention about tax-cut bills that promote “trickle-down, goofy, voodoo economics,” referring to an ill-fated bill to cut capital-gains taxes in the 2011 session.

Beebe said he changed some of his thoughts about capital-gains tax cuts before the 2013 session. “I would have done it a little different way, but Davy was insistent on doing it the way he did, and I acceded to it. This isn’t a dictatorship.”

The governor was especially pleased to sign one of the tax-cut bills.

Act 1398, sponsored by Sen. Jason Rapert, R-Bigelow, will eventually lower the 1.5 percent grocery tax to 0.125 percent.

The tax cut is contingent on the state paying off longterm bond obligations or resolving a decades-old lawsuit that requires the state to pay millions for desegregation efforts. If, in combination or separately, the bond and desegregation costs drop by at least $35 million over a sixmonth period, the tax cut would kick in.

It would reduce state tax revenue by $70 million during its first year, according to the finance department.

As a candidate, Beebe promised to reduce the state’s then-6 percent sales tax on groceries. As governor, he has seen most of the grocery sales tax eliminated.

BIG RIVER STEEL

The Legislature enacted laws to authorize a $125 million bond issue for the proposed Big River Steel plant near Osceola and the payment of bonds for the project.

The proposed plant will employ about 525 full-time workers earning an average annual salary of about $75,000, according to John Correnti of Blytheville, who heads Big River Steel.

Act 1476, sponsored by Rep. Monte Hodges, D-Blytheville,authorizes the state to proceed with a $125 million bond issue under Amendment 82 to the Arkansas Constitution. This is the state’s first project under the amendment, which gives the Legislature authority to order the issuing of bonds for economic-development purposes.

The law also creates a sales and use tax exemption for natural gas and energy purchased by the company starting when the plant begins production, and allows such a firm to carry forward recycling income-tax credits to use for 14 years rather than the former limit of three years.

Act 1303, sponsored by the Joint Budget Committee, includes spending authority for the Economic Development Commission to make up to $20 million in bond payments.

State Economic Development Commission spokesman Joe Holmes said the next thing that will happen is a formal signing on the agreement between the state and Big River Steel and “that should happen as soon as everyone’s schedule can be worked out for all to be here to get it done.”

During the next few months, Big River Steel “will be working on final financing and getting everything in place to close the deal and begin construction, [and] the state will be working through bond attorneys and others to get everything set for the sale of the bonds,” he said.

The goal is for the deal to formally close in the third quarter of this year, Holmes said.

“Once that happens and the company has deposited$300 million into escrow, there will be a groundbreaking, the bonds will be sold and construction will begin. Once the company spends $250 million of its money, then proceeds from the bonds will begin to flow. All this will likely take place in the third quarter or early fourth quarter. We’ll just have to wait and see.”

SOCIAL CONSERVATISM

Before the big three issues of the session, bills on abortion and voting rights held the attention of those at the Capitol. Three times the governor vetoed a bill and had the Republican majority override him. After legislators recessed the session Tuesday, Beebe vetoed three other bills. Lawmakers could attempt to override those when they return in May to adjourn the session.

“Did I get everything I want? Of course not. There were bills that passed that I vetoed that I thought should not have been passed, but that’s a part of the process.Nobody gets their way all of the time,” Beebe said. “Early on there was a lot of partisanship, but there were a lot of social issues that divided, I think, members of the General Assembly more along party lines earlier rather than later.”

House Democratic leader Greg Leding, D-Fayetteville, echoed the sentiment.

“Our caucus was not necessarily united on some of the reproductive-rights legislation, but those were bills that many of us were disappointed passed,” Leding said. “They tended to be emotional, and that got a lot of attention early on in session.”

A law banning most abortions after 12 weeks of gestation if a heartbeat can be detected has already drawn a legal challenge. A federal judge is scheduled to hear arguments May 17 on whether to prevent the law from going into effect.

Act 301 became law after the Legislature overrode Beebe’s veto of the measure. It allows abortion in cases of rape or incest, or when the mother’s health will be irreparably damaged because of the pregnancy or when the fetus has insurmountable health problems and could not survive outside the womb.

The House voted 56-33 to override, the Senate voted 20-14.

A second law, Act 171, also took effect over the governor’s veto. It has not been challenged in court, though the American Civil Liberties Union argues that it violates case law by limiting access to abortion before a fetus is viable, considered to be at about 24 weeks.

It bans all abortions at 20weeks except in cases of rape or incest, or to save the mother’s life or prevent catastrophic injury to her health or major bodily functions. The law prohibits abortions even if the fetus has catastrophic health problems. The House voted 53-28 to override, the Senate voted 19-14.

Lawmakers also overrode a Beebe veto and passed a law requiring Arkansas voters to present photo identification in order to vote. It is Act 595. The House voted 52-45 to override, the Senate voted 21-12.

The law instructs the secretary of state to create rules requiring county clerks to issue voter-identification cards at no cost to individuals who don’t have other valid forms of identification and have filled out voter-registration applications. The bill becomes effective Jan. 1, 2014, but only if the state has the money to issue the voter-ID cards.

Under previous state law, poll workers ask for identifying documents, but voters are not required to show them.

Front Section, Pages 1 on 04/28/2013